How to price your products with tax-inclusive pricing, with examples and formula

Tax-inclusive pricing is a great way to price your products that leaves your students with no surprises at checkout and offers you more control over your finances. As a refresher, the sales tax, VAT, or GST rate, is determined by the location of the student who is buying your product, not your location. Being able to price your courses and products so your students know how much they’ll pay, no matter what the tax rate is where they are, is a massive advantage for you.

At Teachable, our goal is always to help creators monetize their expertise while offering the control and flexibility to grow their online businesses the way they want to. With Teachable’s tax-inclusive pricing on teachable:pay, you have the power to do exactly that. You get to decide whether to price your courses with taxes included or not, a flexibility other platforms don’t offer. Plus, we help you work smarter instead of harder when it comes to pricing and taxes, by helping you improve conversion. Tax-inclusive pricing alone can increase conversion on your products by up to 22%.

What is tax-inclusive pricing?

Tax-inclusive pricing gives you the option to display one consistent price across your sales pages through checkout. Meaning, the price your students see on your sales page is the price they pay in full when they decide to purchase. Some platforms default to this setting, but with Teachable you get to choose whether you want taxes included or not.

This is especially important for creators based in, or who have a lot of students based in, countries with high sales, VAT, or GST taxes. For example, countries in the European Union and the United Kingdom can have these higher sales (VAT) taxes that when added to your course price, can make students do a double-take. But with the tax-inclusive pricing, you can give students the peace of mind of no surprises at checkout, which helps reduce abandoned carts.

How to strategically price your course using tax-inclusive pricing

If you choose to use tax-inclusive pricing you’ll likely want to re-evaluate your pricing first. Let’s walk through a scenario to demonstrate why you might want to do this:

Say you set your tax-inclusive price at $100. You’ll only make what’s leftover after taxes are deducted. In some places, the tax rate could be over 25%, in which case your net revenue before processing fees would be $80. While in other places it could be under 10%, in which case your net revenue would be $90 or more before processing fees. So, to properly price your courses and products with inclusive pricing but without hurting your bottom line, we’ve got some tips for you.

Find out the tax rates for your audience

Once you choose tax-inclusive pricing and turn it on, the prices you have currently set will be considered to have the tax included. So if you don’t adjust them, your net revenue will decrease. Instead, price strategically to show your customers one price and to make sure your finances stay healthy.

Remember: Sales tax rates are determined by where the student is located, not the creator.

Your students will pay taxes based on where they’re located. The best way to strategically price for this is to consider where the majority of your audience and/or students are located. If most of your customers are in the United States, you can make a guess that the sales tax rate is probably between 4% and 7%. But if most of your students are located in Australia, you know the GST rate for them is 10%, while students in Sweden have a VAT tax rate of 25%.

Evaluate your current pricing for your products

The logical next step is to evaluate your current pricing for each of your existing products. Make sure your course pricing is accurate and that you’re valuing your knowledge appropriately.

Think about everything you’re offering your students. Consider what you might have changed or added since you first created your course or product. Have you added more modules? Maybe you upgraded the videos in your courses. Whatever it may be, you should make sure you’ve properly priced everything. And that you’ve made increases as necessary before adjusting your prices to be tax inclusive.

Choose an inclusive price

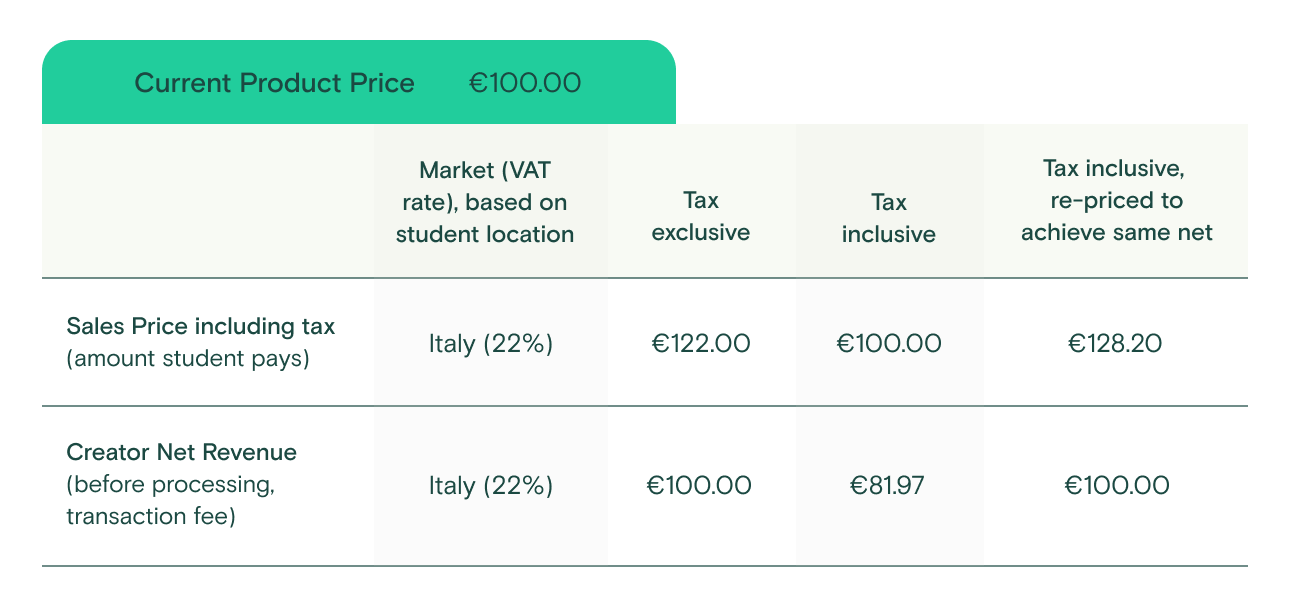

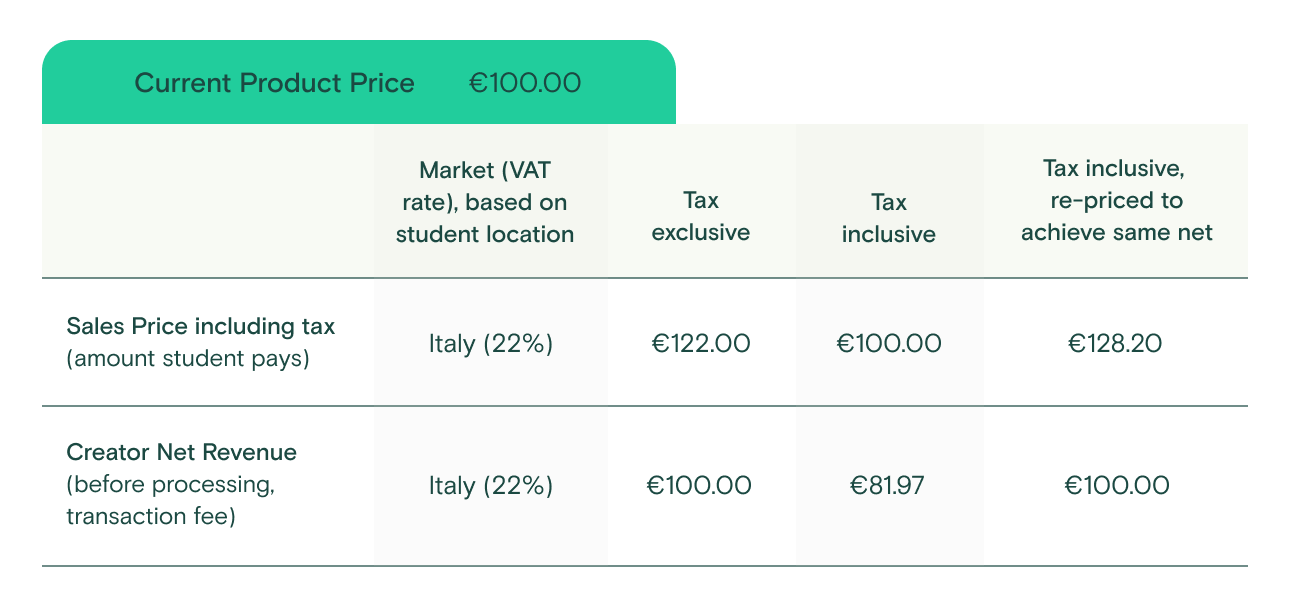

The next step is to choose your tax-inclusive prices. Consider what makes the most sense for your business. In the example below, we’re keeping the math simple to help make it easy to understand. The example below shows what tax-inclusive pricing could look like in a vacuum considering taxes in just one country.

When looking at tax-inclusive pricing, the most straightforward way to offset the decrease to your net pay is to use the following formula:

Current product price / (1-sales tax rate) = New price

Here is an example of how the taxes might work without tax-inclusive pricing (tax exclusive) and with tax-inclusive pricing.

Using Italy’s VAT rate of 22%, the formula would look like this:

100 / (1-0.22) → 100 / (0.78) = 128.21

Set a time when you want to check in on how it’s going

As a business owner and online creator, you know better than anyone that sales don’t happen in a vacuum. There are a few things at play. Making your products tax-inclusive can help bump your conversion rate, which can offset any sales impacts you see from increasing the face value prices on your sales page. You can always change prices back or adjust them to find some middle ground after the fact. Whatever you do, keep track of what changes in your sales margins and track how it goes.

Why use tax-inclusive pricing?

There are numerous reasons to turn on tax-inclusive pricing for your school. But perhaps the biggest of them all is that it can boost conversion on your products by up to 22%. The control offered by Teachable when it comes to tax-inclusive pricing is unmatched.

Plus, it means there are no surprises for your students either. When you turn on tax-inclusive pricing you can be sure your students are seeing the price they’ll pay at checkout. Reduce the risk of abandoned carts or students rethinking their purchase by helping them see accurate prices. This one-price solution means that students all around the globe can purchase confidently with no surprises.

Who is eligible for tax-inclusive pricing?

No matter what plan you’re on with Teachable you can turn on tax-inclusive pricing. But you have to be enrolled in teachable:pay to be able to do so. Tax-inclusive pricing is just one of the benefits teachable:pay offers.

When you enable teachable:pay you can also choose the schedule you want to be paid on (even daily!). And it offers flexible payment options for your students like Apple Pay, Google Pay, mobile pay, and credit and debit cards. You’ll sell confidently knowing Teachable is automating fraud monitoring and chargeback support to protect your bottom line, while also automating sales tax calculation, collection, remittance, and filing*.

Disclaimer: At Teachable we love providing helpful information for creators getting started with their business. We provide helpful information about taxes, but we are not certified tax professionals. You should always consult your own tax, legal, and financial professionals to determine requirements related to your individual business.

Teachable DOES NOT provide legal or tax advice to users of teachable:pay. By using teachable:pay, You are solely responsible for obtaining any such legal advice and tax advice that You consider appropriate in connection with Your use of teachable:pay.

*Please read our Knowledge Base for more details on tax handling.